BEIJING, March 19 (Xinhua) -- Following is the full text of report on the implementation of central and local budgets in 2012 and on draft central and local budgets for 2013, which was submitted for review on March 5, 2013 at the first annual session of the 12th National People's Congress and was adopted on March 17:

REPORT ON THE IMPLEMENTATION OF CENTRAL AND LOCAL BUDGETS IN 2012 AND ON DRAFT CENTRAL AND LOCAL BUDGETS FOR 2013

First Session of the Twelfth National People's Congress

March 5, 2013

Ministry of Finance of the People's Republic of China

Fellow Deputies,

The Ministry of Finance has been entrusted by the State Council to submit this report on the implementation of the central and local budgets in 2012 and on the draft central and local budgets for 2013 to the First Session of the Twelfth National People's Congress (NPC) for your deliberation and approval and for comments and suggestions from members of the National Committee of the Chinese People's Political Consultative Conference (CPPCC).

I. Implementation of Central and Local Budgets in 2012

In 2012, under the firm leadership of the Communist Party of China (CPC), the people of all the country's ethnic groups worked tenaciously and forged ahead in solidarity, and progress was achieved in economic and social development while ensuring stability. On the basis of this, fresh headway was made in fiscal development and reforms, and government budgets were satisfactorily implemented.

1. Implementation of Public Finance Budgets

National revenue totaled 11.720975 trillion yuan, an increase of 12.8% over 2011 (here and below). Adding the 270 billion yuan from the central budget stabilization fund, utilized revenue totaled 11.990975 trillion yuan. National expenditure amounted to 12.571225 trillion yuan, up 15.1%. Adding the 18.415 billion yuan of central government surplus revenue used to replenish the central budget stabilization fund, the 200 billion yuan used to repay the principal on local government bonds and the 1.335 billion yuan of local government expenditure carried forward to 2013, national expenditure totaled 12.790975 trillion yuan. Total national expenditure therefore exceeded total national revenue by 800 billion yuan.

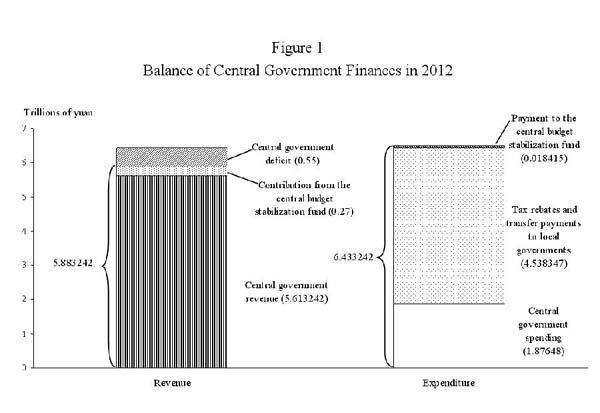

Breaking these figures down, central government revenue amounted to 5.613242 trillion yuan, 100.4% of the budgeted figure and an increase of 9.4%. Including the 270 billion yuan contributed by the central budget stabilization fund, total revenue used by the central government came to 5.883242 trillion yuan. Central government expenditure amounted to 6.414827 trillion yuan, 100% of the budgeted figure and an increase of 13.7%. This consists of 1.87648 trillion yuan of central government spending, up 13.6%, and 4.538347 trillion yuan in tax rebates and transfer payments to local governments, an increase of 13.7%. Adding the 18.415 billion yuan of central government surplus revenue used to replenish the central budget stabilization fund, central government expenditure totaled 6.433242 trillion yuan. Total expenditure of the central government exceeded total revenue, leaving a deficit of 550 billion yuan, the same as the budgeted figure. The outstanding balance on government bonds in the central budget was 7.75657 trillion yuan at the end of 2012, which was under the budgeted limit of 8.270835 trillion yuan for the year.

Graphics shows the balance of Chinese central government finances in 2012, according to the report on the implementation of central and local budgets in 2012 and on draft central and local budgets for 2013, which was submitted for review on March 5, 2013 at the first annual session of the 12th National People's Congress and was adopted on March 17.(Xinhua/Gao Wei)

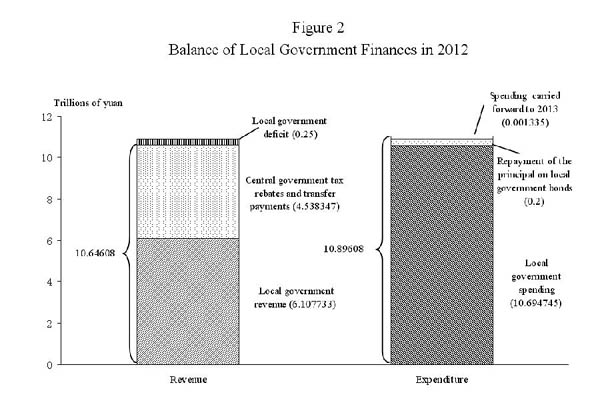

The revenue of local governments came to 6.107733 trillion yuan, an increase of 16.2%. Adding the 4.538347 trillion yuan in tax rebates and transfer payments from the central government, local government revenue totaled 10.64608 trillion yuan. Local government expenditure amounted to 10.694745 trillion yuan, up 15.3%. Adding the 200 billion yuan used to repay the principal on local government bonds and the 1.335 billion yuan carried forward to 2013, local government expenditure totaled 10.89608 trillion yuan. Total expenditure by local governments exceeded total revenue by 250 billion yuan.

Graphics shows the balance of local government finances of China in 2012, according to the report on the implementation of central and local budgets in 2012 and on draft central and local budgets for 2013, which was submitted for review on March 5, 2013 at the first annual session of the 12th National People's Congress and was adopted on March 17.(Xinhua/Gao Wei)

The following is a breakdown of main items in the central budget in 2012:

1) Main revenue items

Domestic VAT revenue was 1.967847 trillion yuan, 97.2% of the budgeted figure. This shortfall was mainly due to small increases in the value-added of industry and the CPI. Domestic excise tax revenue was 787.214 billion yuan, 102.2% of the budgeted figure; revenue from VAT and excise tax on imports amounted to 1.479641 trillion yuan, 99.7% of the budgeted figure; and revenue from customs duties came to 278.274 billion yuan, 103.4% of the budgeted figure. Corporate income tax revenue was 1.208218 trillion yuan, 108.7% of the budgeted figure. It exceeded the budgeted figure largely because actual corporate income tax revenue for 2011 exceeded estimates on which tax was collected that year, with the remainder paid in 2012. Individual income tax revenue was 349.261 billion yuan, 102.7% of the budgeted figure; VAT and excise tax rebates on exports came to 1.042888 trillion yuan, 104.8% of the budgeted figure; and non-tax receipts totaled 284.878 billion yuan, 100.8% of the budgeted figure.

Central government revenue exceeded the budgeted figure by 21.242 billion yuan in 2012. Of this, 2.827 billion yuan from surplus vehicle purchase tax revenue was used to increase spending on highway construction as required by relevant regulations, and the remaining 18.415 billion yuan was used to replenish the central budget stabilization fund for future budgetary purposes.

2) Main expenditure items

In line with the requirements of ensuring steady economic growth, adjusting the economic structure, promoting reform, and improving quality of life, and based on the need for economic and social development, we adjusted the structure of expenditures during budget implementation and focused on increasing investment in areas related to improving quality of life, such as government-subsidized housing, agriculture, water conservancy, energy conservation, and environmental protection, all of which was achieved without exceeding the budget for central government expenditure (including central government spending and transfer payments to local governments).

Education spending reached 378.152 billion yuan, 100% of the budgeted figure and an increase of 15.7%. We provided funds to support the development of preschool education to ease the shortage of preschools. We refined the mechanism to ensure funding for rural compulsory education, helped to repair and upgrade more primary and secondary rural school buildings, and significantly raised subsidies to the central and western regions. We supported the implementation of a plan to improve the nutrition of over 30 million rural students in compulsory education. A total of 34.45 million urban compulsory education students were exempted from tuition and miscellaneous fees and compulsory education was provided to 12.6 million children of rural migrant workers living together in cities. Rural students, including those from counties and towns, and urban students who are studying agriculture-related majors or from poor families were exempted from secondary vocational school tuition fees. We improved the policy system for providing government financial aid to students from poor families, benefiting approximately 15.96 million students, and advanced Project 985 and Project 211, thereby improving college and university infrastructure and comprehensively raising the quality of higher education.

Combining all budgetary expenditures on education from central and local public finances and government-managed funds, total government education spending reached 2.1994 trillion yuan in 2012, or 4% of GDP.

Spending on science and technology came to 229.15 billion yuan, 100.3% of the budgeted figure and a 12.7% increase. Major state science and technology programs were effectively implemented, and we increased investment in the State Natural Sciences Fund and Program 973, thereby securing substantially more funding for key state laboratories and basic research institutes. Significant progress was made in promoting research on cutting-edge technologies and major generic key technologies, as well as research for public benefit. We vigorously supported construction of scientific and technological infrastructure, and promoted open sharing and highly efficient use of scientific and technological resources. We also funded the implementation of scientific and technological projects that benefit the people and encouraged the application of scientific and technological advances.

Expenditure on culture, sports, and media totaled 49.468 billion yuan, 100.2% of the budgeted figure and an increase of 18.9%. Funds were used to grant free admission to public cultural facilities, including 1,804 museums and memorial halls and over 40,000 galleries and libraries, and to make progress in the national cultural information resource sharing project, the rural library project, and other key cultural projects that benefit the people. Funding was provided to intensify protection of key national cultural artifacts, major cultural and historical sites, cultural resources that relate to the early history of the CPC, and intangible cultural heritage. The international broadcasting capabilities of key media were improved, and we supported efforts to take Chinese culture to a global audience and promoted the rapid development of the culture industry.

Spending on medical and health care amounted to 204.82 billion yuan, 100.6% of the budgeted figure and a 17.2% increase. We raised subsidies to the new rural cooperative medical care system and basic medical insurance for non-working urban residents from 200 yuan to 240 yuan per person per year and further raised the proportion of medical expenses that are reimbursable. We put in place a permanent mechanism for compensating community-level medical and health care institutions that implement the basic drug system, and introduced it in all village clinics. We supported trial reforms of public hospitals in 17 cities and 311 counties or county-level cities. We continued to implement basic and major public health service projects and increased medical assistance, thereby enabling more people to benefit to a greater extent.

Spending on social security and employment amounted to 575.373 billion yuan, 100.1% of the budgeted figure and an increase of 22%. We achieved full coverage of the new old-age pension system for the rural population and the old-age pension system for non-working urban residents. We raised basic pensions for enterprise retirees for the eighth consecutive year, with average monthly benefits reaching 1,721 yuan per person. We increased subsistence allowances for urban and rural residents living in areas that receive central government subsidies by an average of 15 yuan and 12 yuan respectively per person per month. We raised subsidies and living allowances for some entitled groups; improved the social assistance system targeted at orphans, people with disabilities, the homeless, and beggars; and increased efforts to help people affected by natural disasters to restore their lives. We improved policies and measures aimed at boosting employment and supported urban residents in finding jobs or starting their own businesses.

The appropriation for guaranteeing adequate housing was 260.16 billion yuan, up 44.6% and 122.9% of the budgeted figure. The main reason for going over the budgeted figure was an increase in subsidies for building government-subsidized housing and supporting infrastructure in urban areas as well as renovating dilapidated rural houses in the course of implementing the budget. Of the total appropriation, 225.389 billion yuan was spent on government-subsidized housing projects, including basically finishing the construction of 6.01 million units of urban housing and starting construction on another 7.81 million during the year. The project to renovate dilapidated rural houses was expanded from the central and western regions to rural areas throughout the country and central government subsidies were raised, which resulted in the renovation of 5.6 million homes in 2012.

Expenditure on agriculture, forestry, and water conservancy came to 599.598 billion yuan, 109.2% of the budgeted figure and a 25.3% gain. The main reason for exceeding the budget was an additional investment during implementation in efforts to provide relief from disasters that affect agricultural production, prevent and control serious floods and droughts, build major water conservancy projects as well as irrigation and water conservancy facilities, reinforce small dilapidated reservoirs, and clean up and improve the flood defenses of small and medium-sized rivers. We provided funding to step up agricultural and rural infrastructure development, move forward with the project to construct small irrigation and water conservancy facilities in 1,250 key counties, launch a campaign to save water and increase grain output, basically complete the work of reinforcing 7,000 small dilapidated reservoirs and cleaning up and improving the flood defenses of 27,500 kilometers of 2,209 small and medium-sized rivers, and support 958 counties in preventing and controlling mountain torrents. We increased subsidies for grain producers and extended the coverage of such policies. We expanded the areas and crop varieties eligible for agricultural insurance subsidies, thereby providing 900.6 billion yuan worth of risk protection to 183 million farming households. We supported the development of a modern seed industry and promoted the application of drought-resistant farming and arable land protection techniques. Last year, 2.002 million hectares of low- and medium-yield cropland was upgraded to high-yield standards, construction started or continued on 235 projects to upgrade water-saving equipment in medium-sized irrigated areas, 1.738 million hectares of irrigated land were created or improved, and the policy of subsidizing and rewarding grassland ecological conservation was expanded to cover all herding and semi-herding counties designated by the state. We increased investment in comprehensive poverty relief efforts to improve self-development capabilities of rural poverty-stricken areas and the poor population, and construction on 374,200 village-level public works projects was completed with government awards and subsidies, the launching of which were determined by villagers themselves.

Spending on energy conservation and environmental protection came to 199.843 billion yuan, 113% of the budgeted figure and an increase of 23.1%. Spending significantly exceeded the budgeted figure due to extra investment during budget implementation in the project to promote the use of energy-efficient products that benefit the people, as well as in improving the energy efficiency of buildings and laying sewers to complement urban sewage treatment facilities. Funds were spent on accelerating the construction of key energy conservation projects and improving the energy efficiency of 200 million square meters of residential buildings with central heating in northern China. A policy was introduced to promote sales of flat-screen televisions, air conditioners, refrigerators, washing machines, water heaters, and other highly-efficient, energy-saving products, which resulted in sales of such products totaling 32.74 million units for the year. We made funds available to support enterprises in adjusting their industrial structures, decommission outdated production facilities with a total capacity of 19.17 million tons in the coke industry and 59.69 million tons in the cement industry, and close down 5.45 million kilowatts of small thermal power stations. A total of 15,000 kilometers of sewers were built to complement urban sewage treatment systems; the living environment of 12,000 contiguous villages was improved; and ecological protection was strengthened in the key watersheds of the Huai, Hai, and Liao rivers and Tai, Chao, and Dianchi lakes. Key forestry projects were carried out, including one to protect virgin forests, and past achievements in returning cultivated land to forests and grazing land to grasslands were consolidated. Finally, funds were provided to promote the development of new energy and renewable energy as well as to develop a circular economy.

Expenditure on transportation totaled 396.922 billion yuan, 111.3% of the budgeted figure and an increase of 20.3%. The budgeted figure was exceeded largely due to an increase in investment in railway construction during the implementation of the budget. Comprehensive transportation capabilities were improved, national and provincial highways upgraded or expanded, inland waterways improved, and 194,000 kilometers of rural roads built or upgraded. We provided fuel subsidies for public transportation and other public service industries. We also granted subsidies to local governments for phasing out tolls on government-financed Grade II highways.

National defense spending was 650.603 billion yuan, 100% of the budgeted figure and an 11.5% increase. Funds were used to improve living and training conditions for our troops, support the military in promoting IT application, strengthen development of new- and high-technology weapons and equipment, and enhance the country's modern military capabilities.

Spending on public security reached 188 billion yuan, 102.9% of the budgeted figure and an increase of 10.9%. We improved the mechanism for ensuring funding for primary-level procuratorial, judicial, and public security departments to enhance their service capabilities and gave priority to supporting procuratorial, judicial, and public security departments in the central and western regions in clearing their debts arising from infrastructure building.

3) Central government tax rebates and transfer payments to local governments

Central government tax rebates and transfer payments to local governments totaled 4.538347 trillion yuan, 100.6% of the budgeted figure and an increase of 13.7%. This figure includes 2.147118 trillion yuan in general transfer payments and 1.879152 trillion yuan in special transfer payments. General transfer payments accounted for 53.3% of total transfer payments, an increase of 0.8 percentage points over 2011.

2. Implementation of Budgets for Government-managed Funds

In 2012, revenue of government-managed funds nationwide came to 3.751701 trillion yuan, while expenditure amounted to 3.606904 trillion yuan. Below is a breakdown of these figures.

Receipts of central government-managed funds totaled 331.344 billion yuan, 110.8% of the budgeted figure and an increase of 5.8%. Receipts exceeded the budgeted figure mainly because funds from the surcharge on electricity generated from renewable energy sources were included in last year's budget for the first time in accordance with the law, so as to support the development of these energy sources. Adding the 82.221 billion yuan carried forward from 2011, revenue of central government-managed funds totaled 413.565 billion yuan in 2012. Expenditure of central government-managed funds totaled 335.463 billion yuan, 88.1% of the budgeted figure and an increase of 8.1%. This total consists of 217.517 billion yuan of central government spending and 117.946 billion yuan in transfer payments to local governments. A total of 78.102 billion yuan from central government-managed funds was carried forward to 2013. The expenditure of central government-managed funds was less than the budgeted figure mainly because some projects were not implemented in 2012 due to insufficient preparatory work, while others were granted less funding in accordance with the principle of determining spending based on revenue.

Revenue of funds managed by local governments reached 3.420357 trillion yuan, a decrease of 10.5% mainly due to fewer receipts from the sale of state-owned land use rights. Adding the 117.946 billion yuan in transfer payments from central government-managed funds, the total revenue of local government-managed funds came to 3.538303 trillion yuan. Expenditure of local government-managed funds totaled 3.389387 trillion yuan, down 10.3%. This total includes 2.841819 trillion yuan of spending from the proceeds of selling state-owned land use rights. Surplus revenue from local government-managed funds was carried forward to 2013.

3. Implementation of Budgets for State Capital Operations

In 2012, revenue from state capital operations nationwide reached 157.284 billion yuan, and total expenditure reached 147.966 billion yuan. The following is a breakdown of these figures.

Revenue from state capital operations of the central government totaled 97.083 billion yuan, 115% of the budgeted figure and an increase of 26.9%. Revenue exceeded the budgeted figure mainly because the proportion of profits from state capital operations of tobacco enterprises collected by the central government was raised five percentage points and the economic returns of enterprises in some industries exceeded expectations in 2011 (revenue from state capital operations of state-owned enterprises is collected as a certain proportion of their profits for the previous year). Adding the 3.107 billion yuan carried forward from 2011, revenue totaled 100.19 billion yuan. Expenditure on the central government's state capital operations came to 92.979 billion yuan, 106.3% of the budgeted figure and an increase of 20.8%. This figure includes 5 billion yuan, up 25%, spent on social security and other areas related to improving quality of life as planned in last year's public finance budgets. Surplus revenue from the central government's state capital operations was used to shore up the capital bases of the five largest power corporations (China Huaneng Group, China Datang Corporation, China Huadian Corporation, China Guodian Corporation, and China Power Investment Corporation), details of which the State Council reported to the Standing Committee of the Eleventh NPC.

Revenue from local governments' state capital operations totaled 60.201 billion yuan, and total expenditure amounted to 54.987 billion yuan.

4. Implementation of the NPC Budget Resolution

In accordance with the relevant resolution of the Fifth Session of the Eleventh NPC, as well as the guidelines of the NPC Financial and Economic Affairs Commission, we strived to do better in public finance work.

First, we faithfully followed a proactive fiscal policy. We increased structural tax reductions and extended the pilot project to replace business tax with VAT from Shanghai to nine provinces and municipalities directly under the central government, including Beijing, and three cities specially designated in the state plan, thereby effectively promoting the development of the service sector and the optimization of the industrial structure and reducing the burden on enterprises. We raised VAT and business tax thresholds, and halved the corporate income tax on small businesses with low profits and expanded the scope of the policy to cover more businesses. Efforts were made to increase government subsidies, raise the income of low-income groups, and boost consumer spending. We improved the structure of government spending to direct more funding toward maintaining and improving quality of life and promote the development of education, health, social security, and other social programs. We better leveraged the role of fiscal and tax policies and worked to adjust the economic structure and balance regional development.

Second, we better ensured funding for county-level governments to perform their functions. We improved the mechanism for ensuring basic funding for governments at the county level, expanded its coverage, and increased the amount of funds guaranteed. The central government allocated a total of 107.5 billion yuan in awards and subsidies for this purpose, 30 billion yuan more than 2011, and provincial-level governments also carried out their responsibility in this regard, which basically made up the shortfall in funds for county-level governments and achieved the policy aim of ensuring these governments have sufficient funding to pay salaries, carry out normal operations, and safeguard the wellbeing of their residents.

Third, we strengthened management of local government debts. We further improved the system for managing local government debts, put them under standardized supervision, clarified who is responsible for repaying them, and saw to it that all local government bonds due in 2012 were redeemed on time. We also made notable progress in clearing debts of county-level governments.

Fourth, we pushed ahead with the work on releasing government budgets and final accounts. Relevant central government departments released their budgets and final accounts in accordance with relevant regulations. In addition to appropriations for spending on official overseas travel, official vehicles, and official hospitality disclosed in their 2011 final accounts and 2012 budgets, specific details regarding such expenditures were also made public. The information these departments provided was more meticulous, covered similar time periods, and was presented in a standardized form.

Fifth, we improved performance-based budget management. We worked hard to stress the importance of achieving results in the full course and every link of our budget management, formulated and promulgated a work plan for performance-based budget management, and made steady progress in carrying out pilot projects in this area. We also redoubled efforts to manage the implementation of budgetary expenditure, and implemented budgets more quickly. We tightened oversight of public finances, observed strict financial and economic discipline, and ensured smooth implementation of major policy decisions and plans of the central leadership.

Sixth, we dealt with suggestions and proposals. We handled a total of 3,803 suggestions and proposals in 2012. We also improved communication with NPC deputies and CPPCC National Committee members and increased efforts to translate their suggestions and proposals into policies and measures as well as concrete action.

The year 2012 was the last year of the term of this government. During the past five years, we fully implemented the policy decisions and plans of the CPC Central Committee and the State Council, strived to improve the structure of government spending, advanced reform of the fiscal and tax systems, strengthened scientific management of public finances, and made good use of its functions and role, thereby spurring steady, sound economic and social development and also giving the development and reform of public finance a new appearance.

Public finance played an effective role in macro-control. In response to the global financial crisis, finance departments comprehensively implemented a proactive fiscal policy, employed a full range of macro-control tools, and adopted a variety of well-targeted policies and measures. When formulating policies, we took a holistic and balanced approach in order to not only bolster domestic demand, particularly consumer demand, and strive to expand exports, but to increase effective supply by raising overall agricultural production capacity and supporting enterprises in developing production. We focused on imposing strong short-term macro-control but also paid attention to enhancing the sustainability of the country's development, thereby promoting steady and rapid economic development and continued improvement in people's lives. We managed public finances more scientifically, implemented policies with the proper force and pace, and kept China's deficit-to-GDP and debt-to-GDP ratios at safe levels. We strengthened supervision of local government debts, effectively managed and controlled risks, and maintained the sound operation and sustainability of public finance. From 2008 to 2012, government revenue increased at an average annual rate of 18% and totaled approximately 43.4 trillion yuan for the five-year period, 26.42 trillion yuan more than the total for the preceding five years, and government expenditure increased at an average annual rate of 20.4% and totaled approximately 46.37 trillion yuan for the five-year period, 28.65 trillion yuan more than the previous five-year period.

Remarkable progress was achieved in maintaining and improving quality of life. Government spending on education increased to 4% of GDP in 2012 from 3.12% in 2007, which has greatly promoted education reform and development and led to the formation of an institutional basis for providing schooling to students from poor families. Government spending on medical and health care nationwide grew at an average annual rate of 29.3% and totaled 2.52 trillion yuan over the past five years. Significant progress was made in reforming the pharmaceutical and health care systems, and a medical insurance system that covers the whole population is emerging. Construction of government-subsidized housing picked up speed, with more than 18 million units of government-subsidized urban housing built and housing in run-down urban areas renovated nationwide over the past five years, making government-subsidized housing accessible to 12.5% of the country's urban households in 2012. The dilapidated houses of 9 million rural households were also renovated. We extended the old-age insurance system to all non-working urban residents and the rural population, with 130 million people aged 60 and over drawing a monthly pension. Greater support was lent to employment and business start-ups, a new social aid system was basically put in place, and the mechanism to increase social aid and social security benefits when consumer prices rise began to take shape. Steady progress was achieved in making public cultural facilities open to the public free of charge, development of the public cultural service system was accelerated, reform of the cultural administrative system proceeded across the board, and cultural programs and industries enjoyed sound development. The government successfully completed recovery and reconstruction work following the massive Wenchuan earthquake and major mudslide in Zhugqu; gave strong support to post-disaster recovery and rebuilding work following the Yushu earthquake; assisted in the fight against other major natural disasters; and ensured basic living conditions for the victims of disasters. Central government spending on maintaining and improving quality of life grew at an average annual rate of 21.1% and totaled 16.89 trillion yuan for the five-year period, which accounted for over two-thirds of total central government spending.

Impetus was given to adjusting the economic structure and balancing regional development. We strongly supported scientific and technological innovation; optimized the structure of government spending on science and technology, with the focus on supporting basic research and research on cutting-edge and generic technologies; and encouraged faster implementation of major national science and technology projects. We increased fiscal and tax policy support to strengthen agriculture, benefit farmers, and enrich rural areas. Over the past five years, central government spending on agriculture, rural areas, and farmers increased at an average annual rate of 23.5% to reach a total of 4.47 trillion yuan for the period, 2.92 trillion yuan more than the previous five-year period, which helped to balance urban and rural development. We supported the implementation of the plan for adjusting and reinvigorating ten key industries, helped accelerate the development of strategic emerging industries, established a sound fiscal and tax policy system to support the service sector, and introduced and improved fiscal and tax policies to promote sound development of small and medium-sized enterprises, especially small and micro-businesses. Solid progress was made in conserving energy, reducing emissions, and protecting the ecological environment, with government spending in this area totaling 1.14 trillion yuan nationwide over the past five years, an average annual increase of 24.1%. Sound mechanisms for subsidizing and rewarding grassland ecological conservation were also put in place. Transfer payments were constantly increased, with payments from the central to local governments growing at an average annual rate of 27.1% from 1.4 trillion yuan in 2007 to 4.03 trillion yuan in 2012. These funds mainly went to the central and western regions, ethnic minority areas, old revolutionary base areas, poor areas, main grain-producing areas, and key ecological zones. Following the redistribution of government funds through central government transfer payments, per capita government expenditure rose significantly in the central and western regions. This redistribution has strongly promoted the equalization of basic public services between regions, with the eastern region giving strong support to the development of the two regions.

Fiscal and tax reforms continued to deepen. We made substantial progress in establishing fiscal and tax systems and mechanisms conducive to developing scientifically. We improved the transfer payment structure to raise the share of general transfer payments from 50.8% of total transfer payments in 2007 to 53.3% in 2012. We established a mechanism to ensure basic funding for all county-level governments and deepened the reform to place county finances directly under the management of provincial-level governments and township finances under the management of county governments. The government budget system improved as we eliminated all off-budget funds and placed all government revenue and expenditure under budgetary management. We improved the way surplus revenue is used, and established a sound budget stabilization fund system. We fully implemented the reform to establish a departmental budget system, and extended the coverage of the centralized treasury collection and payment system to all levels of departments at and above the county level that prepare their own budgets and to those with the right conditions at the township level. We made significant headway in VAT reform and in expanding the scope of the VAT system, improved the excise tax system over time, smoothly reformed taxes and fees related to refined oil products, made steady progress in reforming property and resource taxes, unified the tax systems for domestic and overseas enterprises, constantly improved the personal income tax system, and further standardized income distribution between the government on the one hand and enterprises and individuals on the other.

Fiscal management steadily improved. Basic work on fiscal management and its development at the primary level of government intensified, and overall progress was achieved in making fiscal management more scientific and meticulous. The new Law on Corporate Income Tax and Law on Vehicle and Vessel Tax came into force, and progress was achieved in revising the Budget Law. Local government budgets were made significantly more complete and their implementation more timely, balanced, effective, and secure. Work on introducing performance-based budget management moved forward in an orderly manner, and government budgets and final accounts were released on a regular basis and according to institutional procedures. Important headway was made in requiring government departments to release information regarding their spending on official overseas trips, official vehicles, and official hospitality. We verified all the debts of local governments and obtained a clear picture of their debt position, introduced policies and measures to strengthen debt management by local government financing companies, and stayed vigilant against financial risks in public finance. We carried out the work of issuing bonds for local governments with the approval of the State Council in an orderly manner, worked to clear the outstanding debts of local governments to reduce their burden, and gradually improved oversight mechanisms that cover all government-managed funds and all stages of fiscal operations.

The achievements made in fiscal work over the past five years were the result of the scientific policymaking and correct leadership of the Party Central Committee and the State Council, increased oversight and effective guidance of the NPC and its deputies and the CPPCC National Committee and its members, and concerted, strenuous efforts of all regions and departments and the people of all of China's ethnic groups. At the same time, we are soberly aware of the following problems and shortcomings in our fiscal work: Progress in fiscal and taxation legislation needs to be accelerated, as tax legislation is still in its infancy. Fiscal and tax policies need to play a bigger role in promoting change in the growth model and regulating income distribution. Reform of the fiscal system needs to be accelerated in order to clearly define powers and corresponding spending responsibilities among different levels of government. The system of transfer payments requires improvement, as there are currently too many items funded by special transfer payments. The structure of the tax system is not sufficiently balanced, and the development of local tax systems has fallen behind schedule. The excessive non-tax revenues collected by some local governments are having an adverse effect on the stability of government receipts. Government funds are not used efficiently in some localities and organizations that are prone to extravagance and waste, which requires performance-based budget management to be introduced more quickly. Some localities are under immense pressure to repay their debts, and the potential risks involved must not be overlooked. We must take these problems seriously and adopt effective measures to solve them.

II. Draft Central and Local Budgets for 2013

1. General Requirements for Public Finance Work and Budget Compilation

In the course of public finance work and compiling budgets in 2013, we need to comprehensively implement the guiding principles of the Eighteenth National Congress of the Party; follow the guidance of Deng Xiaoping Theory, the important thought of Three Represents, and the Scientific Outlook on Development; take developing scientifically as the underlying guideline and accelerating a change in China's growth model as the major task; and adhere to the general principle of making progress while maintaining stability in all aspects of our work. We also need to continue following a proactive fiscal policy, deepen reform of the fiscal and tax systems, press ahead with adjusting the distribution of national income, adhere to a holistic approach, further improve the structure of government spending, maintain and improve quality of life, economize in every area, strictly limit regular expenditure, manage public finances more scientifically and strictly in accordance with the law, use government funds more efficiently, and promote steady and sound economic development and social harmony and stability.

2. Priorities of the Proactive Fiscal Policy

First is to increase the fiscal deficit and government debt by appropriate amounts to maintain necessary spending intensity. The lag effect of past structural tax cuts will make it hard for government revenue to grow fast this year and funds available from the central budget stabilization fund will be modest. At the same time, however, increases in fixed government expenditures, especially spending on improving quality of life and continuing to support economic growth and structural adjustments, will require the fiscal deficit to expand by an appropriate amount and a corresponding increase in central and local government bonds issued.

Second is to continue to reform the tax system and improve the structural tax cut policy to promote economic structural adjustments. We will continue to extend the scope of the pilot project on replacing business tax with VAT, push ahead the development of modern service industries and industrial structural upgrading, and further lighten the burden on enterprises. We will identify and rescind unreasonable and unlawful charges and lower exorbitant fees. We will also cut import tariffs on some energy and resource products, key spare parts and components, and raw materials.

Third is to further improve the structure of government spending to maintain and improve quality of life. We will continue to give priority to key areas of spending and work energetically but within our means. We will increase spending on education, public health, social security, and other areas related to people's lives; lend our support to developing agriculture, water conservancy, and national defense; promote the rapid development of old revolutionary base areas, ethnic minority areas, border areas, and poor areas; and advance urbanization and the integrated development of urban and rural areas. We will stringently limit regular expenditure, economize on administrative overheads wherever possible, observe strict financial and economic discipline, and oppose extravagance and waste. We will strengthen performance-based management of government spending and use funds more efficiently.

Fourth is to push forward a shift in China's growth model to raise the quality and performance of economic growth. We will provide funds to ensure the smooth implementation of major national science and technology projects, support basic research and research on cutting-edge technologies, and encourage technological innovation by enterprises. We will support development of strategic emerging industries and modern service industries. We will promote ecological progress, energy conservation, and emissions reductions; help speed up the development of new, renewable, and clean energy sources and of a circular economy; support strengthening ecological conservation in key areas and consolidating progress in returning cultivated land to forests; and improve the forestry subsidy policy and the policy on providing compensation for conserving forest ecology.

3. Public Finance Budgets for 2013

On the basis of the targets for economic and social development in 2013, the economic and social policies, and the general requirements for compiling budgets determined at the Central Economic Work Conference, we have set the following targets for public finance budgets in 2013.

Revenue of the central government is projected to reach 6.006 trillion yuan, up 7% on the actual figure for 2012 (here and below). Adding the 100 billion yuan from the central budget stabilization fund, revenue in 2013 should amount to 6.106 trillion yuan. Central government expenditure is estimated at 6.956 trillion yuan, up 8.4%. This consists of 2.0203 trillion yuan incurred at the central level, 4.8857 trillion yuan paid out as tax rebates and transfer payments to local governments, and 50 billion yuan of reserve funds for the central budget. Total expenditure will therefore exceed total revenue, leaving a deficit of 850 billion yuan, 300 billion yuan more than in 2012. The ceiling for the outstanding balance on government bonds in the central budget stands at 9.120835 trillion yuan.

|

| Graphics shows the budgetary balance of Chinese central government finances for 2013, according to the report on the implementation of central and local budgets in 2012 and on draft central and local budgets for 2013, which was submitted for review on March 5, 2013 at the first annual session of the 12th National People's Congress and was adopted on March 17. (Xinhua/Gao Wei) |

Revenue collected by local governments is projected to be 6.657 trillion yuan, up 9%. Adding the 4.8857 trillion yuan in tax rebates and transfer payments from the central government, revenue of local governments should amount to 11.5427 trillion yuan. Local government expenditure is expected to come to 11.7543 trillion yuan, up 9.9%. Adding the 138.4 billion yuan used to repay the principal on local government bonds, total expenditure will come to 11.8927 trillion yuan. Total expenditure exceeds total revenue by 350 billion yuan, which will be made up, with the approval of the State Council, by the Ministry of Finance issuing bonds on behalf of local governments and incorporated into provincial-level government budgets. (As revenue and expenditure budgets of local governments are compiled by local people's governments and subject to approval of people's congresses at their respective levels, related data is still being collected. The abovementioned revenue and expenditure figures of local budgets have been compiled by the central finance authorities.)

Combining central and local budgets, national revenue will come to 12.663 trillion yuan, an increase of 8%. Including the 100 billion yuan from the central budget stabilization fund, total available revenue is projected to be 12.763 trillion yuan. National expenditure is budgeted at 13.8246 trillion yuan, up 10%. Adding the 138.4 billion yuan used to repay the principal on local government bonds, total expenditure will come to 13.963 trillion yuan. Total expenditure is projected to exceed total revenue by 1.2 trillion yuan, an increase of 400 billion yuan from last year. This deficit is equivalent to about 2% of GDP.

Main items provided for in the central budget in 2013

1. Main revenue items

Revenue from domestic VAT will amount to 2.095 trillion yuan, up 6.5%; revenue from domestic excise tax, 855 billion yuan, up 8.6%; revenue from VAT and excise tax on imports, 1.5875 trillion yuan, up 7.3%; revenue from customs duties, 297 billion yuan, up 6.7%; revenue from corporate income tax, 1.3123 trillion yuan, up 8.6%; revenue from individual income tax, 381.5 billion yuan, up 9.2%; revenue from vehicle purchase tax, 242.6 billion yuan, up 8.9%; VAT and excise tax rebates on exports, 1.111 trillion yuan, up 6.5%; and non-tax revenue, 275.5 billion yuan, down 3.3%, which is the result of rescinding and exempting some administrative fees.

2. Main expenditure items

In compiling the central expenditure budget, we have further improved the spending structure, giving more support to key areas while limiting regular expenditure. The main expenditure items are arranged as follows.

The appropriation for education is 413.245 billion yuan, up 9.3%. We will maintain sustained, steady growth in government education investment and strengthen management over the use of educational funds to ensure they are used more efficiently. We will support the rapid development of preschool education, further increase funding for rural compulsory education, continue the project to improve the nutrition of rural students in compulsory education, and strive to shore up weak rural schools providing compulsory education. We will help to improve the conditions of regular senior secondary schools and strengthen infrastructure for vocational education, support the implementation of Project 985 and Program 2011 to promote intensive development of higher education, faithfully carry out the national policy of providing financial aid to students from poor families, and promote education equality.

The appropriation for science and technology is 252.991 billion yuan, an increase of 10.4%. This will be used to ensure the smooth implementation of major national science and technology projects, and support research on cutting-edge technologies and major generic key technologies as well as research for public benefit through Program 863, the National Key Technology R&D Program and special research projects in public service industries. We will increase investment in Program 973 and other programs aimed at strengthening basic research. We will leverage the role of the state seed fund for encouraging the application of advances in science and technology, push ahead with building capacity to provide public services for regional scientific and technological innovation, and promote innovation-driven development. The pilot program on using science and technology to benefit the people will be carried out in more areas, and efforts to bring scientific and technological advances within the reach of ordinary people at the community level will be accelerated.

The appropriation for culture, sports, and media is 54.054 billion yuan, up 9.3%. More public cultural facilities such as museums will be opened to the public free of charge and public cultural services at the community level will be improved. We will provide strong support to protecting cultural resources related to the early history of the CPC, key cultural artifacts, underwater cultural heritage, and major cultural and historical sites. The international broadcasting capabilities of key media will be enhanced, and we will support the development of cultural industries and encourage exports of cultural products and services. More public fitness facilities will be built, and stadiums and gymnasiums will be opened to the public free of charge or at low prices.

The appropriation for medical and health care stands at 260.253 billion yuan, up 27.1%. We will raise per capita government subsidies for the new type of rural cooperative medical care system and basic medical insurance for non-working urban residents from 240 yuan to 280 yuan per year. We will extend the pilot program to insure urban and rural residents against major diseases to cover more areas, consolidate and improve the system of basic drugs and the new mechanism for running community-level medical and health care institutions, and accelerate reforms in public hospitals. We will raise annual per capita spending on basic public health services from 25 yuan to 30 yuan, and extend the coverage of certain services. We will continue supporting the implementation of major public health service projects, expand the scope of medical assistance, and offer more medical aid to people with special difficulties. In addition, the oversight of food and drug safety will be enhanced to protect people's legitimate rights and interests.

The appropriation for social security and employment is 655.081 billion yuan, up 13.9%. We will further raise the basic pension benefits of enterprise retirees by around 10%, and consolidate past achievements in securing full coverage of the new old-age pension system for rural residents and the old-age pension system for non-working urban residents. We will increase subsistence allowances at an appropriate rate and raise per capita monthly benefits for urban and rural recipients by a further 15 yuan and 12 yuan, respectively, in areas that receive subsidies from the central government. We will adjust subsidies and living allowances for entitled groups, and continue to give out Spring Festival subsidies to needy people, including subsistence allowance recipients. We will further improve the social assistance system and ensure basic living conditions of disaster victims. We will increase policy support for employment and lend key groups a helping hand in finding jobs.

The appropriation for guaranteeing adequate housing is 222.991 billion yuan, up 5.3% over the budgeted figure and down 14.3% from the actual figure mainly due to a one-off additional investment in building government-subsidized housing and supporting infrastructure in urban areas as well as renovating dilapidated rural homes made while adjusting the spending structure during budget implementation last year. This amount is also based on the consideration that there will be fewer government-subsidized housing projects in 2013. If calculated based on the number of housing projects that will be built this year, however, government investment is actually increasing. Priority will be given to investing in the construction of public rental housing and the renovation of rundown areas.

The appropriation for agriculture, forestry, and water conservancy is 619.588 billion yuan, up 12.8% over last year's budgeted figure and 3.3% over last year's actual figure. The disparity between the budgeted and actual figures for last year was primarily due to a one-off increase in investment in building major water conservancy projects and irrigation and water conservancy facilities, reinforcing small dilapidated reservoirs, and cleaning up and improving the flood defenses of small and medium-sized rivers, which was made by adjusting the spending structure in the course of budget implementation. This year's appropriation will be used to improve small irrigation and water conservancy facilities in key counties and extend the project to more counties, strengthen the flood defenses of small and medium-sized rivers, reinforce small dilapidated reservoirs, and prevent and control disasters from mountain torrents. We will improve the policy of providing general subsidies for purchasing agricultural supplies, continue the policy on providing subsidies for superior crop varieties, and increase subsidies for purchasing agricultural machinery to further mechanize China's agriculture. We will expand coverage of subsidies for agricultural insurance premiums and raise subsidies for some types of insurance. We will provide funds for carrying out major agricultural science and technology projects in the seed industry and other industries, spreading key technologies for preventing and mitigating natural disasters and for ensuring stable grain output and further increasing it, and promoting the application of scientific and technological advances in agriculture. We will assist in boosting development of modern agricultural production and specialized farmer cooperatives, and support innovations in agricultural production and operation systems and the development of commercial organizations that provide agricultural services. We will increase investment in overall agricultural development, and with the focus on major grain-producing areas and counties, continue to support the upgrading of low- and medium-yield cropland to high-yield standards as well as the upgrading of water-saving equipment in medium-sized irrigated areas. We will improve the policy on subsidies and awards for grassland ecological conservation and support development of replacement industries, further refine the compensation system for growing and managing forests that bring ecological benefits and increase compensation, improve the comprehensive fiscal policy for poverty alleviation and support poor areas in developing industries with unique features and advantages, and continue to implement the government award and subsidy system for village-level public works projects and strengthen management and maintenance of completed projects. We will extend the pilot reform to relieve state-owned farms of social services and the demonstrations and trials on comprehensive rural reform.

The appropriation for energy conservation and environmental protection is 210.127 billion yuan, an increase of 18.8% over last year's budgeted figure and 5.1% over the actual figure. The disparity between the budgeted and actual figures for last year was mainly due to a one-off additional investment in improving the energy efficiency of existing buildings and laying sewers to complement urban sewage treatment facilities when we adjusted the spending structure during budget implementation last year. Support for controlling air pollution will be increased to make innovations in mechanisms for comprehensive treatment, clearly define responsibilities, and refine related rules and regulations. We will lend impetus to building key energy conservation projects, help spread the use of advanced environmentally-friendly products, and boost the development of the environmental services industry. Efforts to promote energy-saving products that benefit the people will be intensified, and the work on spreading the use of five categories of energy-efficient industrial products, including electric motors, draught fans, and water pumps, will be accelerated. We will promote the prevention and control of water pollution in key watersheds as well as the construction and operation of sewer networks, help strengthen ecological conservation in lakes with good water quality, and encourage efforts to resolve the issue of safe drinking water. Demonstrations of comprehensive prevention and control of heavy metal pollution will be carried out, and another round of environmental cleanup in contiguous rural areas will be launched. We will strengthen development of national demonstration centers for recovering mineral resources from city waste, promote harmless disposal of kitchen waste and recovery of resources from it, and extend trials on upgrading industrial parks to make their operations more circular. We will provide funds to continue implementing the second phase of the project to protect virgin forests and consolidate past achievements in returning cultivated land to forests while increasing subsidies for some of these projects. We will support R&D on and the industrial application of new-energy vehicle technologies and accelerate the development of new, renewable, and clean energy.

The appropriation for transportation is 397.386 billion yuan, up 0.1%. These funds will be used to support construction of public transportation infrastructure, continue to provide fuel subsidies for public transportation and other public service industries, and provide subsidies to local governments to phase out tolls on government-financed Grade II highways.

The appropriation for national defense is 720.168 billion yuan, an increase of 10.7%. Funds will be used to support efforts to make the armed forces more mechanized and information-based, improve the working and living conditions of service personnel, and strengthen national defense and the military so as to safeguard national security.

The appropriation for public security is 202.937 billion yuan, up 7.9%. This will be used to improve the mechanism for ensuring funding for primary-level procuratorial, judicial, and public security departments, strengthen the capacity of these departments in poor areas, and support the provision of legal assistance.

Expenditure on general public services will come to 135.058 billion yuan, up 1.5%. The main reason for this relatively small increase is the need to abide by relevant regulations of the central leadership and strictly limit regular spending as well as overheads and project outlays of administrative bodies.

3) Central government tax rebates and transfer payments to local governments

Central government tax rebates and transfer payments to local governments will reach 4.8857 trillion yuan, up 7.7%. Of this amount, general transfer payments will account for 2.453835 trillion yuan, up 14.3%, and special transfer payments will account for 1.926586 trillion yuan, up 2.5%. General transfer payments designed to equalize access to basic public services will reach 981.225 billion yuan, up 14.3%, which includes 152.5 billion yuan in awards and subsidies for implementing the mechanism to ensure basic funding for county-level governments, up 41.9%; 42.3 billion yuan for key ecological zones, up 14%; and 31.825 billion yuan in awards to major grain-producing counties, up 15%. General transfer payments to old revolutionary base areas, ethnic minority areas, and border areas will total 62.19 billion yuan, up 11.2%.

4) Overview of the central budget stabilization fund

The central budget stabilization fund had a balance of 106.978 billion yuan after the transfer of 270 billion yuan to the budget at the beginning of 2012, and it was replenished with surplus revenue of 18.415 billion yuan during implementation of the budget, leaving a balance of 125.393 billion yuan at the end of the year. Following the transfer of 100 billion yuan to the budget in early 2013, 25.393 billion yuan remains.

An analysis of the above expenditures shows that in 2013 the central government will spend a total of 1.57125 trillion yuan, an increase of 13.5% over the budgeted figure and 9.6% over the actual figure, in areas that directly affect people's lives, namely education, medical and health care, social security, employment, government-subsidized housing, and culture. Central government spending on public transportation, energy conservation, environmental protection, community affairs, and other areas closely related to people's lives will amount to 1.715003 trillion yuan. Appropriations from the central budget for agriculture, rural areas, and farmers will total 1.3799 trillion yuan, an increase of 11.4%. This figure consists of 542.683 billion yuan used to support agricultural production; 170.055 billion yuan in direct subsidies to grain growers, general subsidies for purchasing agricultural supplies, and subsidies for purchasing superior crop varieties and agricultural machinery; 605.112 billion yuan for the development of rural education, health care, and other social programs; and 62.05 billion yuan for expenses related to stockpiling agricultural products and associated interest payments. Most central government tax rebates and general transfer payments to local governments will also be used to maintain and improve the quality of people's lives and benefit agriculture, rural areas, and farmers.

It should be noted that spending on improving quality of life and on agriculture, rural areas, and farmers does not constitute a single budgetary item. For ease of deliberation, we have combined all spending items concerned, so there is some overlap in the statement of expenditures.

4. Budgets for Government-managed Funds

Receipts of central government-managed funds will come to 361.913 billion yuan, an increase of 9.2%. Adding the 78.102 billion yuan carried forward from last year, total revenue of central government-managed funds will reach 440.015 billion yuan in 2013. Outlays of central government-managed funds will be 440.015 billion yuan, an increase of 31.2%. This figure consists of 256.401 billion yuan of central government spending, up 17.9%, and 183.614 billion yuan in transfer payments to local governments, up 55.7%.

Revenue of funds managed by local governments will reach 3.313702 trillion yuan, down 3.1%, which includes 2.740401 trillion yuan from the sale of state-owned land use rights, down 3.9%. Adding the 183.614 billion yuan in transfer payments from central government-managed funds, total revenue of local government-managed funds will reach 3.497316 trillion yuan. Expenditure of local government-managed funds will total 3.497316 trillion yuan, up 3.2%, including 2.804604 trillion yuan of spending earmarked from proceeds of selling state-owned land use rights, down 1.3%.

Combined revenue of funds managed by the central and local governments will reach 3.675615 trillion yuan, down 2%. Adding the 78.102 billion yuan carried forward from last year, revenue of government-managed funds nationwide will total 3.753717 trillion yuan. Expenditure of these funds will amount to 3.753717 trillion yuan, up 4.1%.

5. Budgets for state capital operations

Revenue from the central government's state capital operations will reach 101.1 billion yuan, an increase of 4.1% over 2012. Adding the 7.211 billion yuan carried over from last year, revenue will total 108.311 billion yuan. Expenditure financed by state capital operations will come to 108.311 billion yuan, an increase of 16.5%, including 6.5 billion yuan, up 30%, transferred to the public finance budget to be spent on improving the quality of people's lives, such as social security.

Revenue and expenditure from local government state capital operations will each amount to 55.84 billion yuan.

Combining central and local budgets, national revenue from state capital operations will reach 156.94 billion yuan, and adding the 7.211 billion yuan carried over from last year, total revenue is projected to be 164.151 billion yuan. Expenditure from these operations will come to the same amount.

Budgets for social insurance funds have been compiled on a trial basis for the past three years, and relevant institutional systems and management mechanisms have been established over time. In accordance with the requirements of the NPC, we worked together with the Ministry of Human Resources and Social Security and the Ministry of Health to officially prepare the 2013 national budget for social insurance funds, the first of its kind in China, which includes every fund prescribed in the Social Insurance Law. Combining central and local budgets, nationwide revenue of social insurance funds will be 3.282878 trillion yuan, an increase of 9.9% over the estimated figure for 2012. This includes 2.466372 trillion yuan of insurance premiums and 718.031 billion yuan of government subsidies. Expenditure of social insurance funds will total 2.791331 trillion yuan nationwide, an increase of 16.8% over the estimated figure for 2012. This year, revenue will exceed expenditure, leaving a surplus of 491.547 billion yuan, and the year-end balance is projected to be 4.09431 trillion yuan once the balance from 2012 has been rolled over.

III. Deepening Fiscal and Tax Reforms and Making Management More Scientific to Successfully Implement the 2013 Budgets

1. Implementing Policies and Finding Savings

We will carry out all measures for implementing the proactive fiscal policy to promote steady economic growth, economic structural adjustments, and a shift in the economic growth model. We will closely follow and analyze policy outcomes and strive to make policies more targeted, flexible, and forward-looking based on the economic situation. We will implement all tax and fee reduction and exemption policies to reduce the burden on enterprises and individuals. We will give high priority to spending in key areas, limit regular expenditure, and spend money where it can be used most efficiently. We will ensure funding for key areas such as agriculture, education, medical and health care, social security, employment, government-subsidized housing, and public culture and work hard to maintain and improve the quality of people's lives. We will faithfully comply with the Party Central Committee's eight-point regulations on improving the conduct of the Party and maintaining close ties with the people, economize in every area, and prevent extravagance and waste. We will tighten our belts; strictly limit regular expenditure and spending on official overseas trips, official vehicles, and official hospitality; tighten control over official cars and spending on meetings and business trips; restrict the construction and remodeling of office buildings and other facilities; further streamline and regulate celebrations, symposiums, forums, and other activities; and strive to reduce administrative costs.

2. Deepening Fiscal and Tax Reforms and Improving Systems and Mechanisms

We will move faster to improve the fiscal system to ensure that the financial resources of central and local governments are commensurate with their respective powers. We will make basic public services equally accessible to all and promote the development of functional zones. We will properly define the powers and spending responsibilities of central and local governments, and find a better way to distribute revenue between them as we replace business tax with VAT. We will improve the transfer payment structure to reduce special transfer payments and optimize the transfer payment system to ensure funds are used more efficiently. We will refine the mechanism for guaranteeing basic funding at the county level and provide more funds for county-level governments to deliver basic public services. We will enhance the system for managing budgetary revenue and expenditure and make budgets more complete, transparent, and effective. We will refine the government budget system, bring all government receipts and expenditures under budgetary management, continue to improve the budget system for government-managed funds, optimize the budget system for state capital operations and further increase spending from their revenue on social security and other areas related to improving people's lives, and work to establish an institutional framework and a set of standards for the budget management of social insurance funds. We will accelerate the establishment of a mechanism for sharing the proceeds from the transfer of public resources. We will improve the mechanism for releasing government budgets and final accounts and standardize which items should be disclosed and how to do so. We will work hard to introduce a performance-based budget management system and establish in due course a mechanism for applying it throughout the course of budget work. We will reform the tax system to make it more conducive to promoting structural improvements and social fairness. We will expand the pilot project to replace business tax with VAT to more areas, quickly work out a plan to carry out the project in the transportation industry and some modern service industries across the country, and further improve the VAT system. We will reform resource taxes and levy price-based taxes on more resources, refine the excise tax system and consider how to levy excise tax on products that consume excessively high levels of resources or are highly polluting, and work to establish a local tax system. In addition, we will make full use of the role fiscal and tax policies play in adjusting income distribution; support the reform of state-owned enterprises and public institutions as well as the banking, pricing, investment and financing systems; help to steadily improve the socialist market economy; and stimulate the internal vitality and driving force of economic and social development.

3. Strengthening Fiscal Management and Improving Budget Performance

We will strengthen the legal framework for managing public finances. We will cooperate on revising the Budget Law, revise the regulations on enforcing it accordingly in a timely manner, and promote the formulation of fiscal and tax regulations such as a law on the environmental protection tax and the regulations on enforcing the Government Procurement Law. We will make budgets more detailed and scientific, and increase the funds available at the start of the year for budgetary items. We will bolster management of basic expenditures, promote compilation of itemized rolling budgets, and strengthen budget management of state-owned assets allocated by administrative agencies and institutions. We will strengthen the collection and administration of tax and non-tax revenue in accordance with the law, effectively manage the implementation of budgetary expenditures, and make their implementation more timely, balanced, effective, and secure. We will refine the single treasury account system and standardize the management of special fiscal accounts. We will promote performance-based management of budgets, strengthen evaluations of the performance of major expenditures on improving the quality of people's lives, and use government funds more efficiently. We will improve basic work on fiscal management and its development at the primary level. We will implement accounting norms and systems for public institutions. We will strengthen the management of local government debts; resolutely stop some localities securing financing or guaranteeing the payment of debts in violation of the law and regulations; place in due course revenue and expenditure of local government debts under budgetary management based on type; and establish a mechanism to warn when local government debts get too large. We will strengthen oversight and inspections to ensure that the major decisions, plans, and fiscal and tax policies of the central leadership are effectively implemented, and put China on a firmer and more sustainable fiscal course. We shall willingly accept the oversight of the NPC and listen to comments and suggestions from the CPPCC National Committee with an open mind in order to better manage public finances.

Fellow Deputies,

Successfully implementing the 2013 budgets is of great significance. Under the leadership of the Party Central Committee with Comrade Xi Jinping as General Secretary, we need to follow the guidance of Deng Xiaoping Theory, the important thought of Three Represents, and the Scientific Outlook on Development; work diligently and forge ahead; steadily promote fiscal development and reform; and make positive contributions to attaining the objectives for economic and social development in 2013 and achieving new victories in establishing a moderately prosperous society in all respects.